Unveiling the Enigma: Stocks Persist Amid Fed’s Conflicting Signals

Within the dynamic realm of finance, where subtleties wield significant influence, the recent surge in stocks has seized the attention of both investors and analysts. This piece delves into the intricacies of the present market landscape, unraveling the forces steering the persistent uptick in stocks despite the contradictory cues emerging from the Federal Reserve.

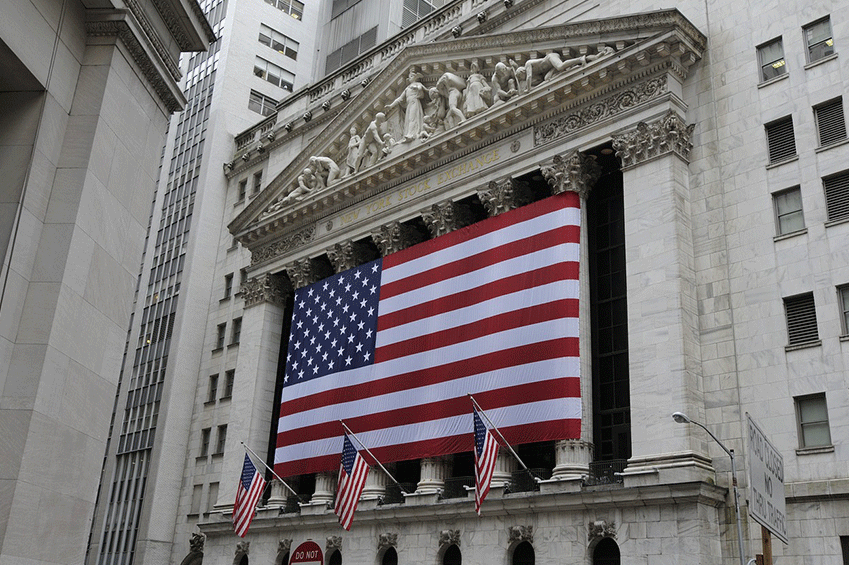

Surfing the Swell: Unyielding US Equities

As dusk descends upon Wall Street, US equities stand unshaken, grasping onto gains even amidst uncertainty. The Nasdaq 100, a bastion of technological prowess, scaled an impressive 0.3%, marking a historic pinnacle that reverberated across financial horizons. This surge, highlighted by the index consecutively setting new closing records, sparks inquiries and stirs curiosity among avid market followers.

Fed’s Balancing Act: Yield Decline Amidst Mixed Signals

The intrigue deepens as yields dwindle during the afternoon session, triggered by unforeseen housing data, instigating speculation among traders regarding the Federal Reserve’s next course of action. The central focus revolves around the Fed’s capacity to orchestrate a gentle economic transition, hinting at a plausible rate adjustment. Recent statements from Federal Reserve Bank of Richmond President Thomas Barkin, implying a readiness to reduce interest rates given continual inflation progress, further stoke the speculative fervor in the market.

Navigating Unfamiliar Terrain: Tech Sector’s Impact on the Surge

A pivotal player in this market upswing is the tech-centric Nasdaq 100. Its ascent to unprecedented heights signifies the enduring dominance of the technology domain, shaping the market landscape persistently. Investors keenly observe tech stocks, with behemoths like Apple, Amazon, and Microsoft contributing substantially to the sector’s supremacy. The Nasdaq’s consecutive record closings underscore the tech sector’s resilience amidst overarching economic uncertainties.

Fed’s Impact on Market Sentiment

Comprehending the Federal Reserve’s role in shaping market sentiment stands pivotal in deciphering the ongoing surge. The market reacts acutely to every nuance of the Fed’s pronouncements, evident in the yield decline following Barkin’s remarks. The prospect of a smooth economic transition and potential rate adjustments resonates optimistically with investors, bolstering the sustained upward trend in equities.

The Inflation Puzzle: Trigger for Transformation?

A pivotal element steering market dynamics is the evolving discourse surrounding inflation. Recent strides in this sphere have triggered speculations regarding the Fed’s reaction. Will they trim rates to uphold economic equilibrium, or is this merely a transient respite preceding a possible correction? The market watches attentively, perched on the edge, as the Fed grapples with delicately balancing economic growth and inflation control.

Tech Titans and Market Dominance

The Nasdaq’s ascent symbolizes the tech sector’s leadership in propelling market surges. As technology continues its evolution, permeating every facet of life, the market mirrors this paradigm shift. Investors seeking sustained returns draw reassurance from the resilience of tech giants, illustrating how the sector’s innovation and adaptability bolster its dominance.

Navigating Economic Turbulence: S&P 500 Nears Historic Highs

While the Nasdaq basks in the limelight, the S&P 500 steadily inches closer to an all-time peak. This underlying index, mirroring broader market sentiment, showcases the collective resilience of diverse sectors. Barkin’s hint at potential rate adjustments adds another layer of intricacy to the market narrative, shaping how investors perceive and position themselves in anticipation of forthcoming developments.

Conclusion: Decoding Market Signals in the Symphony

To conclude, the ongoing surge in stocks amidst the Fed’s conflicting signals weaves a compelling narrative in the financial realm. The convergence of tech sector fortitude, inflation dynamics, and the Federal Reserve’s influence paints a multifaceted picture. Both investors and analysts find themselves deciphering signals in this intricate market symphony, where each note contributes to the evolving melody of economic resilience and uncertainty. Amidst navigating uncharted territories, the only certainty remains—the interplay of these factors will persistently sculpt the trajectory of equities in the foreseeable future.